Exchanging currency is an essential part of international travel, but it can be confusing and sometimes costly if you’re not careful. Whether you’re preparing for a trip abroad or looking for the best ways to convert money, understanding how currency exchange works can save you time and money. This guide will help you navigate currency exchange like a pro.

1. Understanding Currency Exchange Rates

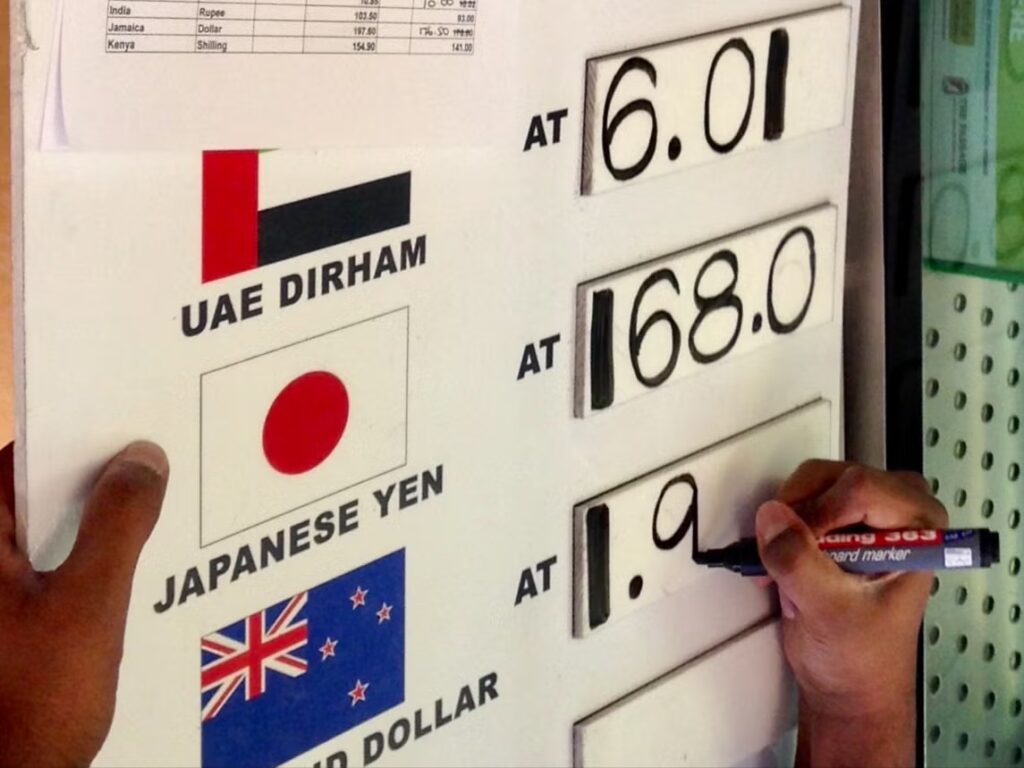

A currency exchange rate determines how much one country’s currency is worth in another. These rates fluctuate daily based on supply and demand, geopolitical events, and economic factors.

To check the latest exchange rates:

- Use currency converter apps like XE Currency or Google Currency Converter

- Check financial news websites or your bank’s website

- Look at the rates displayed at exchange offices and airports (though these are often less favorable)

The mid-market rate (the rate banks use when trading currencies) is the best benchmark for fair exchange rates. Always compare the offered exchange rate with the mid-market rate to avoid overpaying.

2. Best Places to Exchange Currency

Where you exchange money can make a huge difference in how much you get. Here are the best and worst options:

Best Places to Exchange Currency:

- Banks & Credit Unions – Generally offer competitive exchange rates with lower fees.

- Online Currency Exchange Services – Some websites, like Wise (formerly TransferWise), offer real exchange rates with low fees.

- ATMs in Foreign Countries – Using your debit card at an ATM abroad often gives you a better rate than airport kiosks or hotels. Choose ATMs affiliated with major banks to avoid high fees.

Places to Avoid:

- Airport Currency Exchange Booths – These have the highest fees and worst exchange rates.

- Hotel Currency Exchange Services – Convenient but often overpriced.

- Standalone Exchange Kiosks in Tourist Areas – They take advantage of travelers unfamiliar with rates.

3. How to Get the Best Exchange Rates

Here are some practical tips to ensure you get the most out of your currency exchange:

- Use a No-Foreign-Transaction-Fee Credit Card – Some credit cards, like Chase Sapphire Preferred or Capital One Venture, don’t charge extra fees on international purchases.

- Withdraw Local Currency from ATMs – Bank-affiliated ATMs often offer better exchange rates than money exchange offices.

- Avoid Dynamic Currency Conversion (DCC) – When paying with a credit or debit card abroad, always choose to be charged in the local currency. If you select your home currency, the conversion rate is usually much worse.

- Exchange Money Before You Travel – If possible, get foreign currency from your bank at home before your trip, especially if you’re heading to a country with a less common currency.

- Use Mobile Payment Apps – Some apps like PayPal, Wise, and Revolut allow currency exchange at near mid-market rates.

4. Common Currency Exchange Scams to Watch Out For

While most exchange services are legitimate, scams do exist. Here are some common ones to avoid:

- Fake Exchange Offices – Some places advertise “no commission” but offer extremely poor rates. Always compare with the mid-market rate.

- Shortchanging – Some cashiers may count your money incorrectly or slip in counterfeit bills. Always double-check your cash.

- Tampered ATMs – Scammers sometimes install card skimmers on ATMs to steal your card information. Use ATMs inside banks or well-lit, secure areas.

5. Final Thoughts

Understanding currency exchange can help you avoid unnecessary fees and get the most value for your money while traveling. The best strategy is to use a combination of methods: withdraw from ATMs, use a travel-friendly credit card, and exchange cash at reliable locations. By planning ahead and staying informed, you can make your travels smoother and more cost-effective.

Would you like recommendations for travel credit cards with no foreign transaction fees? 😊